Charitable Trusts: A Win-Win for Everyone

Would you like to make a large gift to a cause you believe in but need encouragement to make it happen? You don’t need a motivational pep talk to get you there; you just need the US Tax Code! (You didn’t think we’d say that, right!?)

The Tax Code offers something called the “Charitable Trust”, which allows you to split some of your money – or even better, appreciated real estate or stock – with a charity. You and the charity can get distributions now or later, and you can earn a charitable deduction today.

There are two main types of Charitable Trusts:

Charitable Lead Trust (CLT) – when the charity gets the distributions for a period of years and the balance goes to your family

Charitable Remainder Trust (CRT) – when you get distributions while living and the charity gets what’s left

The splitting (or “fractionalizing”) of the transfer between you and the charities is what gives the CRT and CLT their special qualities.

What are the benefits of charitable trusts?

Income Tax Deduction: For either a Charitable Lead Trust or a Charitable Remainder Trust, you get a current tax deduction for the value of what is given to charity. So, what is given? For a CLT, it’s a gift now. For a CRT, it’s a gift in the future. Either way, these gifts are smaller than face value (because you keep some value in the process yourself) but they have value today which becomes the amount of your income tax charitable deduction. If you are able to itemize deductions, then the deduction will reduce your income tax liability.

Reduced Estate Taxes: Once the charitable trust is funded, these assets are out of your estate for estate tax purposes. This reduces the amount of tax your estate has to pay upon your death.

Recognize Wealth Replacement: Some donors would like to replace the wealth given to charity in a charitable remainder trust. In that case they can replace it with life insurance on their lives. The cash flow from the trust will be paid toward the life insurance premiums, but rarely does this use up all of the annual trust distributions. Upon your death, your heirs will receive the proceeds from life insurance purchased with the charitable trust.

Here’s an example of how this plays out.

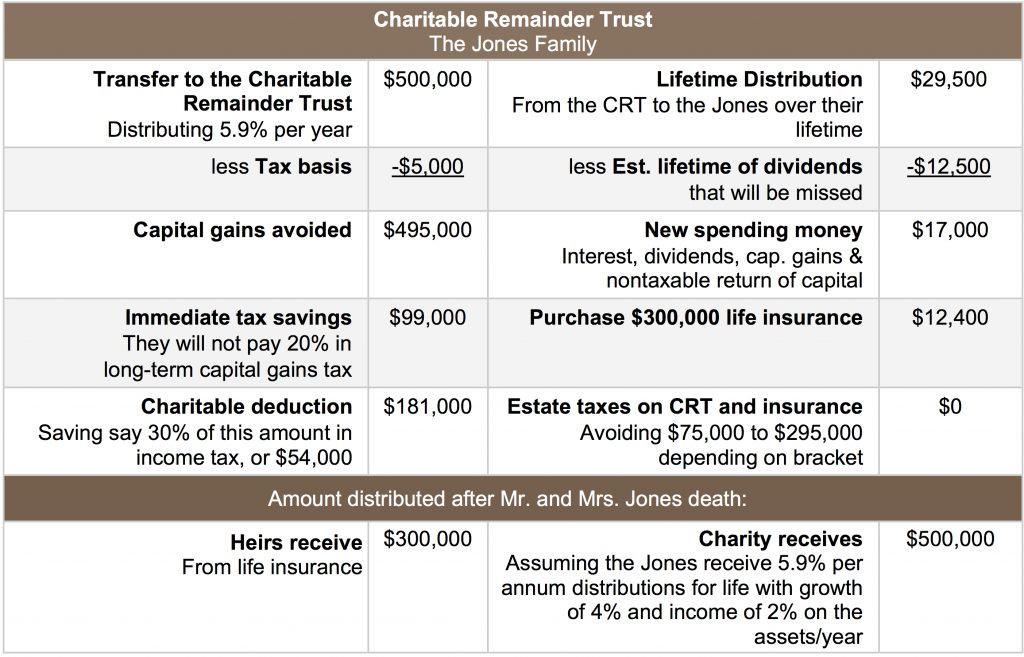

Mr. and Mrs. Jones, age 70 and 71, own a block of stock in a company that they purchased several years ago. They realize that they are over-concentrated in the holding and want to diversify. They realize that if they sell it, they will have less to work with (welcome to the Tax Code!).

After consulting with an estate planning attorney, the couple comes away with an idea: set up a Charitable Remainder Trust, transfer the stock to the trust through their broker, and then sell the stock. There will be $0 in capital gains to pay. The trust will pay them distributions that they predetermine. (For CRTs, they would have to at least receive 5%, but no more than 50% of the trust’s assets per year.)

Applying a formula, the Joneses will get a tax deduction for the value of what they give to charity. What are they giving? They give money that will come to the charity in the future–a future gift that has value today–which becomes the amount of their income tax charitable deduction.

They plan to purchase life insurance so the proceeds go to their heirs tax-free. If they are healthy, Mr. or Mrs. Jones (or both) can insure their lives, or the life of a child. If the life insurance is held in an irrevocable insurance trust, the proceeds can go to their heirs and income and be estate tax-free.

Here’s a spreadsheet of their findings:

Want to learn more about charitable trusts? Read the WealthCounsel’s article, Understanding Charitable Remainder Trusts or the Journal of Accountancy article, Charitable Planning: CRTs, CLTs and the Increasing Payment CLAT.