Like-Kind Exchanges: Defer Capital Gains Taxes on Real Estate

Raise your hand if you want to avoid paying capital gains taxes for as long as possible. The good news is that you can, if you have a property that you plan to sell and have eyed property that you would like to quickly turn around and buy.

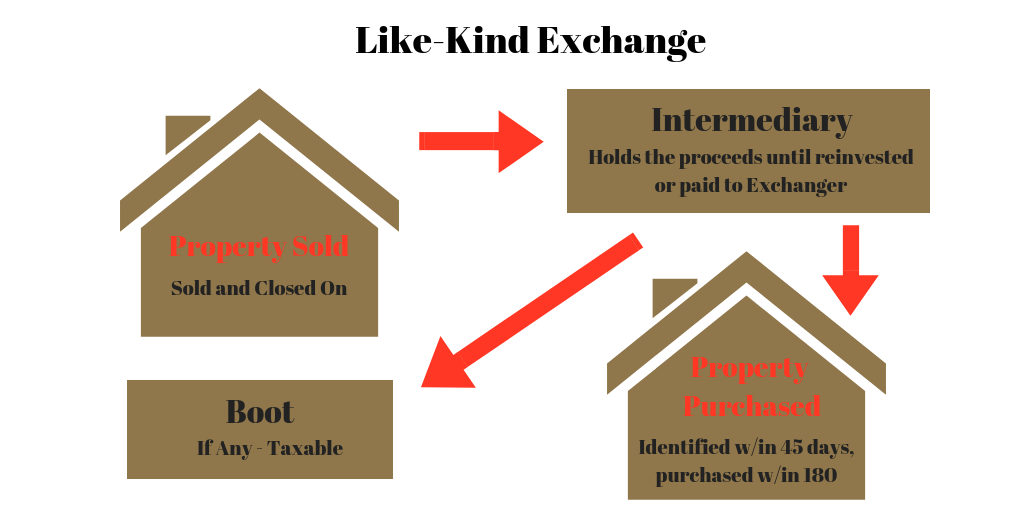

In a “like-kind” exchange, the seller (“exchanger”) sells one property and buys one or more other properties of a like-kind with the proceeds, e.g., sells land and buys an apartment house. Up to three properties may be purchased for every one sold.

How Are Like-Kind Exchanges Carried Out?

The property sold must be held for use in a trade, business, or investment. Primary and secondary residences and commercial properties bought and sold in the business of selling real estate don’t qualify. Combination-use property (think owner-occupied two-family home) can work as to the non-residence portion.

What you have to do is sell and close on one property and, within 45 days, identify up to 10 properties that you want to buy, and actually close on no more than three of them within 180 days of the first closing. During that time a Qualified Intermediary holds the proceeds, not you. The Intermediary is an independent third party. Title insurance company affiliates, independents, and attorneys (who have not represented you in the two years prior to the start of the exchange) can act in this capacity.

Any profit that is pocketed and not invested is known as “boot” and will be subject to capital gains taxes. The profit is deemed to be pocketed if you keep any of it, and it is 100% taxable.

There are so many rules that it only makes sense to work with a Qualified Intermediary who knows their way around like-kind exchanges. One common misconception is that the amount of an outstanding mortgage reduces capital gain. Wrong! Only capital expenditures can add to tax basis and thus reduce capital gain. Another is that you have to sell, then buy. You can actually reverse this arrangement, though it adds to the complexity.

Done correctly, the taxpayer defers any capital gains tax until another sale occurs. This can be repeated in chain link fashion indefinitely under the current law.

Want to learn about other tax strategies to save money on estate or gift taxes? Read our blog, Estate and Gift Taxes Under the New 2018 Tax Law.