Joint vs. Separate Trusts: Key Differences, Benefits, and Estate Planning Tips for Married Couples

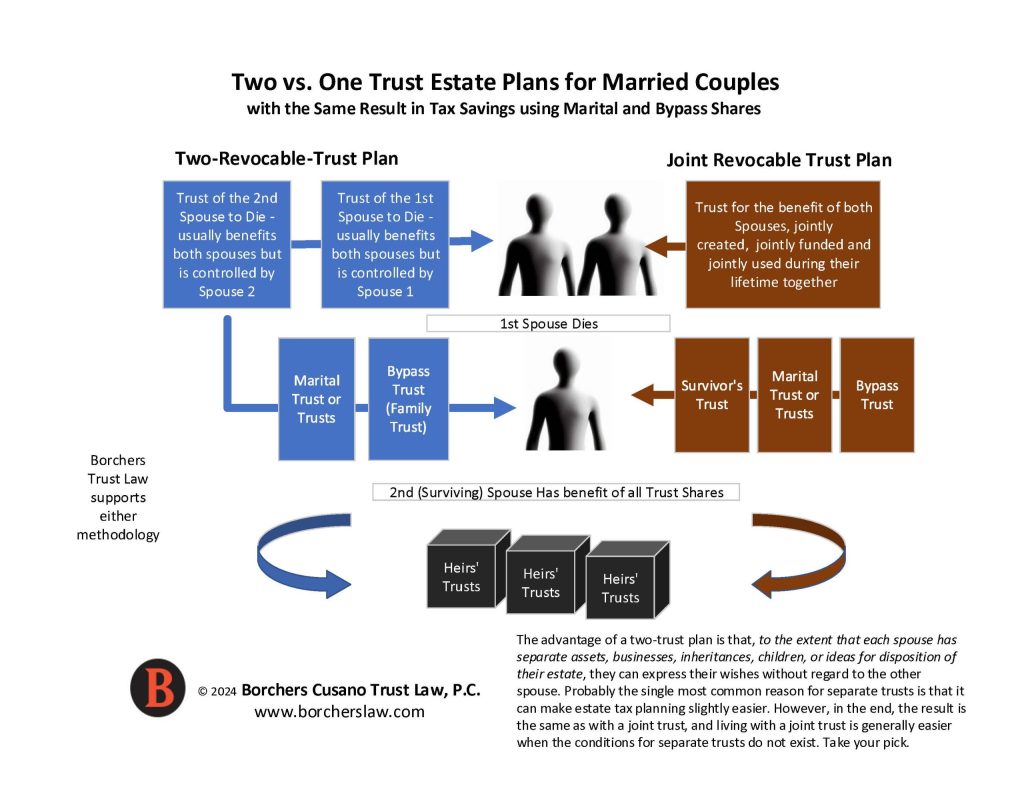

When it comes to estate planning, married couples often face a decision: should they combine their assets into a single joint trust, or should each spouse create a separate trust? This choice is fundamental to the structure of their estate plan and can impact everything from tax planning to how assets are managed and distributed. In this article, we’ll explore the differences between joint and separate trusts, their advantages, and when one might be preferable over the other.

The Traditional Approach: Separate Trusts

For many years, the standard practice in estate planning for married couples involved creating separate trusts—one for each spouse. This method allowed each spouse to manage and control their own assets, businesses, and inheritances, ensuring that their individual wishes were respected, even after they were gone.

Separate trusts offer clear advantages, particularly for couples who have distinct financial responsibilities or separate assets. For instance, if one spouse owns a business or has received a significant inheritance, a separate trust ensures that these assets are managed according to their specific wishes. Additionally, if there are children from previous marriages or unique estate distribution plans, separate trusts can help avoid potential conflicts or complications.

One of the most common reasons for opting for separate trusts is that they simplify estate tax planning. When the first spouse passes away, a portion of their estate can be set aside in what is known as a bypass trust (also referred to as a family trust, credit shelter trust, or “B” trust). This portion is designed to escape estate taxes when the surviving spouse eventually passes. With separate trusts, this process is straightforward, as each spouse’s assets are already delineated.

An Alternative Approach: Joint Trusts

Joint trusts, on the other hand, combine the assets of both spouses into a single trust. This approach might seem less common, but it has been a viable option for decades. Joint trusts are particularly appealing for couples who prefer a more unified approach to estate planning, where all assets are managed and distributed together.

One challenge with joint trusts arises when the first spouse dies. At that point, estate planners need to separate the bypass trust from the joint trust. Although this process isn’t particularly difficult, it can create some initial uncertainty for the surviving spouse regarding which assets they control. However, in practice, this issue is typically manageable, and for most couples, the unified nature of a joint trust provides clarity.

In estate planning, joint trusts are designed to effectively track and allocate assets, ensuring that any assets brought into the joint trust from separate ownership retain their character. Joint assets are generally treated as being owned 50-50 for tax purposes, making the tax implications clear and manageable.

For those with complex financial situations or substantial estates, a joint trust can still be advantageous, especially when considering current tax laws.

The Impact of Evolving Estate Tax Laws on Your Selection

Two decades ago, the federal estate tax threshold was significantly lower, making tax planning with separate trusts more critical. Today, with much higher thresholds, a joint trust can often provide similar tax benefits. In fact, for larger estates subject to the 40% federal tax rate, the flexibility of a joint trust may offer strategic advantages in asset allocation and long-term planning. Being able to choose which assets get allocated to the bypass trust at the first death could be a real advantage since we want to allocate assets most likely to grow to the bypass. The impact? These assets will never see estate taxation until the next generation at the earliest.

Making the Right Choice – Two Versus One Trust

For most couples, the decision between separate trusts versus a joint trust comes down to personal preference and specific financial circumstances. If each spouse has distinct assets or complex estate plans, separate trusts might be the better option. On the other hand, if a couple’s financial life is highly integrated, a joint trust could provide simplicity and ease of management.

It’s also important to note that this decision isn‘t set in stone. Clients who initially choose a joint trust can later convert to separate trusts if their circumstances change, and vice versa. However, making such changes late in life can be challenging due to the established nature of the existing trust arrangements.

Deciding between a joint trust or separate trust is a nuanced decision that depends on various factors, including the complexity of your financial situation, the nature of your assets, and your personal preferences. It’s essential to consult with an experienced estate planner who can guide you through the process and help you make the best choice for your unique circumstances. Additionally, when the first spouse passes, it’s crucial to seek professional advice promptly to ensure that the trust shares are accurately established and managed.

Book a complimentary appointment with a paralegal so she can gather the factors which would impact which trust arrangement would be better for you.