Asset Trust Organizer™

Identify, Organize & Analyze Assets From a Single Dashboard

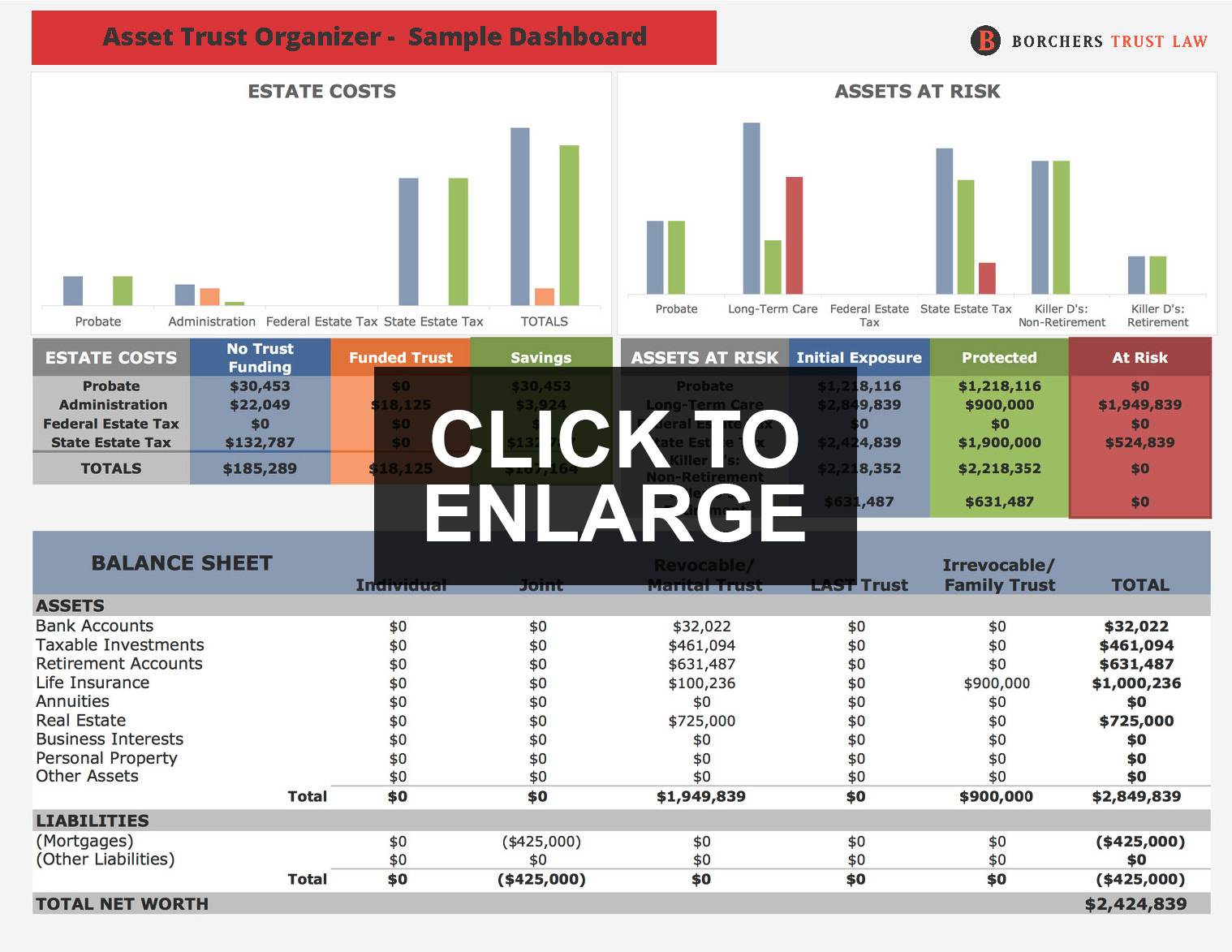

The Asset Trust Organizer (ATO) is a systematic tool that identifies, organizes, and tracks ALL of your assets, and analyzes your exposure to various risks. It is a central component of TrustSupport™ and settling trusts and estates.

It’s easy to stay organized & your family will appreciate it.

Since 2005 the Borchers Trust Law Asset Trust Organizer™ (ATO) has helped clients identify and develop the most advantageous method of tracking their assets and funding their trusts, and more recently helps to assess areas of exposure. The ATO offers a wide range of advantages, including:

Complete Funding Instructions

The ATO lists all assets, states how they must be titled in order to fit with the estate plan, and provides exact ownership and beneficiary designations to ensure your trust is fully utilized and working for you.

More Detailed Than Traditional Advice

The ATO represents a much-needed advance over traditional “how to fund your trust” legal counseling. Typical legal advice instructs clients that their trust should “own” their assets. Often no distinction is made between owning and designating a beneficiary for the assets — a distinction which, for example, is critically important for retirement accounts.

Ownership vs Beneficiary Designations

Sometimes it is important to have a trust own a life insurance policy. In other cases, it’s better to leave the ownership out of the trust, with the trust being the beneficiary. It may even be that the best combination is to name individuals as primary beneficiaries and a trust as contingent beneficiary, or the other way around. The ATO helps determine the best approach.

Tracking Assets & Their Values

The ATO also provides a significant advance in tracking assets (provided that it is continually monitored and kept up-to-date). By tracking where accounts and other assets are located, as well as account numbers and balances, the ATO serves as a complete balance sheet to outline the state of your financial affairs.

Invaluable assistance to family helpers and fiduciaries.

In times of incapacity or the effects of aging, the ATO is invaluable in informing a family helpmate or financial assistant about the family’s assets. After a client passes away, the assets are already listed in the ATO and the administration of the trust can begin from this advanced starting point.

Wondering how much the administration of your trust will cost your family? Concerned about the amount of taxes they will pay? Curious whether there are ways to minimize such expenses? The ATO’s Dashboard has it covered. See at a glance your trust planning at work and what issues to address to round out the plan.

Easy and flexible approaches.

Clients planning their estates for the first time use the Asset Trust Organizer™ to get organized:

- Legacy Plan, Protection Plan and Advanced Plan clients can have the firm fully complete the document, as well as assist with the retitling of assets.

-

Baseline Plan clients receive instructions for how to complete the ATO and retitle assets (changing ownership and beneficiary designations) on their own. Baseline clients have the option to pay an additional fee for our team to complete the ATO for them.

Clients with existing trusts and estate plans who become clients of Borchers Trust Law are encouraged to adopt the ATO and select from the same menu of approaches.

Coordination with ongoing maintenance.

All TrustSupport™ clients must adopt the ATO in order for us to provide these services efficiently. The ATO is included in all trust plan packages, with the exception of the Baseline Trust Plan where it is optional. It is widely used to round out the plan. Learn about more the TrustSupport™ program here.

For personalized guidance on how the ATO might enhance your estate,

schedule a complimentary call with Managing Paralegal, Courtney O’Riordan.

Asset Trust Organizer ™ (C) Borchers Cusano Trust Law, P.C. 2007-2025