Northeast Estate Planning Guide: Northeast Trust Income Tax Rates

Northeast Estate Planning Guide

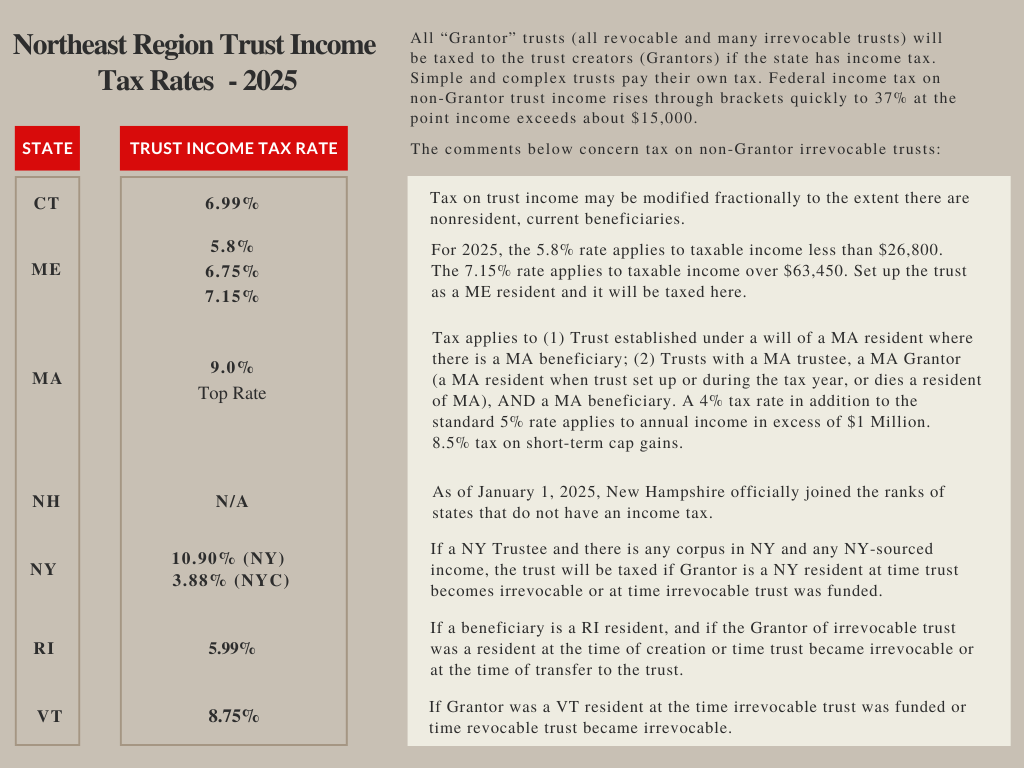

Northeast Region Trust Income Tax Rates

Sometimes you can make money for your beneficiaries by choosing a favorable jurisdiction to administer the trust.

This chart informs you of your tax rate and can help you choose where to administer your trust.

For more states or details, credit goes to Steve Oshins, Esq.

Real-World Example | Case Study

Andy and Sal are retired. They have lived in Connecticut with an income tax rate of 6.99%. They know they could reduce their income tax by moving to another state, preferably one like NH or FL that has no personal income tax.

In weighing the factors, including lifestyle and extreme weather, they decide to stay put in CT. They talk with their CPA and their financial team about improving their trust income taxes and tax outcomes on investment income – managing capital gains and considering a larger role for municipal bonds in their portfolio.

They also reduce the tax on the irrevocable Gift Trust they established for the next generation by using CT’s rule that they can avoid CT tax on trust income taxes for out of state beneficiaries – they happen to have children beneficiaries who live in lower tax bracket states.